For more than ten years now, FMO has been supporting companies that provide electricity solutions to people living remotely. A new evaluation concludes that FMO has played a significant role in the development of this market by tailoring its support to the different needs in the sector. We are fully committed to embracing the lessons learned and further growing our relevance in the sector.

Access to this basic service is so commonplace in the developed world that it is hard to imagine a life without it. Yet this is the daily reality for over half (55%) of the population in Least Developed Countries (LDCs). Globally, some 733 million people–or ~10% of the global population—are without access to electricity. Often, the national electricity grids do not reach their homes, or connecting to them is prohibitively expensive. With the further digitalization of the world economy and the global energy transition, access to electricity is the need of the hour and the future. Thus, decentral renewable electricity solutions such as solar home systems and mini-grids are vital to help remotely located global citizens enjoy the benefits of electricity access.

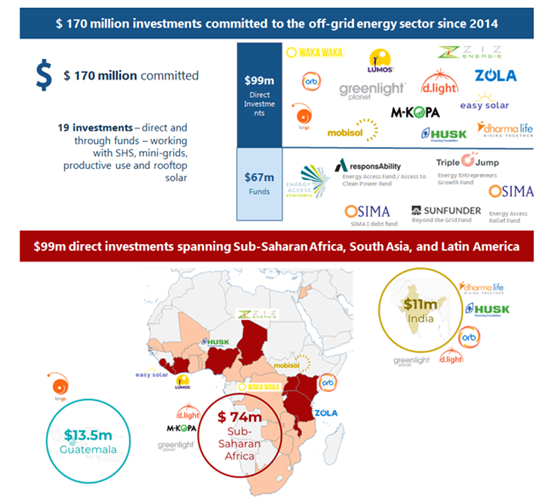

FMO saw the potential of off-grid energy solutions as a channel for improving lives as one of the first international investors more than ten years ago. FMO has since grown its role in the sector, in particular thanks to the availability of funds provided by the Dutch government, such as the Access to Energy Fund. Since 2014, FMO invested some $170 million in 19 different companies and funds active in the sector. Fortunately, we have not been alone: the sector now witnesses sales of standalone solar systems at a level of approximately 8 million units and investments of $300 million each year. At the same time, financing for SDG 7 still needs to double according to the IEA to meet SDG 7 by 2030. To learn from past experiences and share results with investment communities globally, FMO commissioned Greencroft Economics to analyze FMO’s role and results in the sector.

The consultants conclude that FMO’s support to the sector has been adequate and additional to what could have been expected from the commercial market, in particular by contributing to closing transactions that otherwise would not have been viable by developing proof of concept and new financing products. The combination with FMO’s non-financial support to the sector helped it stand out as an investor by actively supporting investees and the sector at large to develop more resilient and responsible business models, including during COVID. Funding from the Access to Energy Fund, MASSIF and Building Prospects has been instrumental to realizing these achievements: some 80% of commitments were made using these Government funds. (Read more about FMO's role in chapter 4 of the report.)

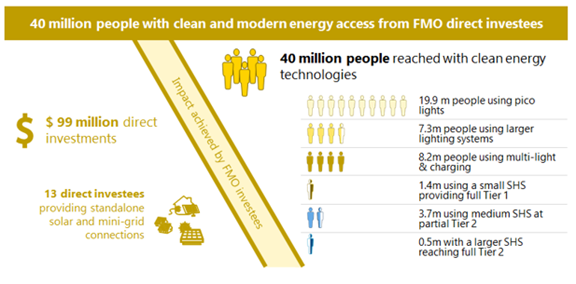

The reason to be active in the sector is to improve lives. For some, it will be their first experience with electricity, but the majority will be “climbing the energy ladder” and gaining access to more and safer energy access (around 73% according to 60Decibels' Why off-gird energy matters, 2020). Greencroft helped FMO understand that through its 13 direct customers it helped to increase electricity access for 40 million people. (This figure is adjsuted for FMO's financial share in its portfolio companies and only includes sales for FMO's active investment period).

Half of them gained first-time electricity access through pico light, available for 4 hours or less per day, or Tier 0 energy access. Some 40% are around Tier 1 energy access, meaning they have at least 4 hours of electricity per day for phone charging, lights and a radio. Another 10% of the people supported by FMO helped support customers to gain (near to) Tier 2 level electricity access, equivalent to power low-load appliances such as a TV or a fan for at least four hours a day. This helps FMO better understand how it creates a “layered” impact on SDG 7.

Indeed, an overwhelming majority of people (88%) that bought an offgrid solar product thought their lives improved because of the increased access to electricity. But lives only really improve when the products do not push people into financial trouble. Therefor FMO attaches great importance to developing strong Client Protection Principles with its customers. FMO has been providing technical assistance in this area since the early stages of the development of the market, which has been flagged as source of non-financial additionality by the review.

Read more about FMO’s impact in the sector beyond the number of people reached in chapter 5.

By following up on the study’s recommendations (see chapter 7), FMO wants to further improve the effectiveness of its support in the sector. Here is what we are doing to improve: