| Final Terms |

| Borrower: |

Nederlandse Financierings-Maatschappij voor Ontwikkelingslanden N.V. (FMO) |

| Ratings: |

Aaa (stable) / AAA (stable) |

| Sustainability Rating: |

C+, Prime by ISS ESG |

| Instrument: |

Fixed Senior Unsecured Notes |

| Size: |

USD 500 million |

| Coupon: |

4.75 % |

| Pricing Date |

8th November 2023 |

| Payment Date: |

15th November 2023 (T+5) |

| Maturity Date: |

15th November 2028 |

| Reoffer Spread: |

SOFR MS+48 |

| Reoffer Price / Yield: |

99.786% / 4.743% (s.a.), 4.800% (annual) |

| Reoffer Spread to UST: |

UST 4.875% 31 October 2028 + 20.65bps |

| Joint Lead Managers: |

Bank of America, Citi, J.P. Morgan, RBC Capital Markets |

Issue Highlights:

• On Wednesday 8th November, Nederlandse Financierings-Maatschappij voor Ontwikkelingslanden N.V. (“FMO”), rated

Aaa/AAA priced a new USD 500 million 5-year green bond at SOFR MS+48bps, equivalent to a spread of +20.65 versus

the on-the-run 5-year US treasury reference.

• This is FMO’s second green benchmark syndication in the US dollar market, following FMO’s 5-year USD 500 million

green transaction in February 2019.

• On the 2nd November, FMO announced a mandate for a series of fixed income investor calls beginning on the 6th

November with a potential USD 500 million (“no-grow”) 5-year RegS transaction to follow, subject to market conditions.

• Following constructive investor meetings, FMO formally announced the transaction on Tuesday 6th November at 15:00

CET with Initial Price Thoughts (“IPTs”) of SOFR MS+51bps area.

• Books opened the next morning at 09:15 CET with revised guidance of SOFR MS+50bps. Indications of Interest reached

in excess of USD 600 million (excl. JLM Interest) at this point.

• Momentum for the transaction was strong throughout the European morning and with books over USD 1 billion (excl.

JLM Interest), at 10:28 CET the final spread was set at SOFR MS+48bps.

• Books closed at 11.00 CET, with final books standing at USD 1.3 billion (excl. JLM interest).

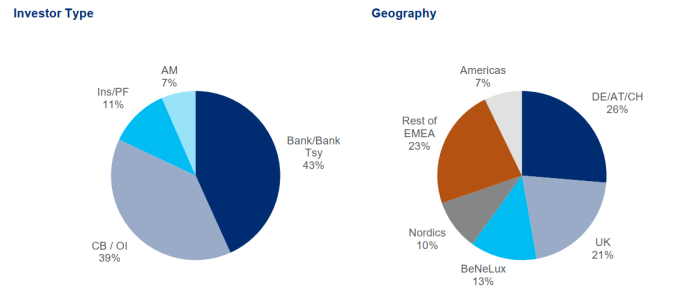

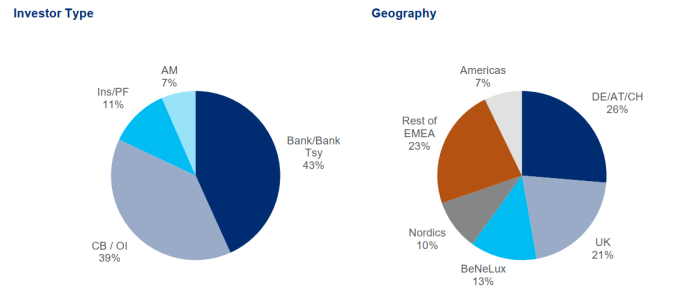

• The transaction was well supported by high-quality, and geographically diverse investor demand. 51 investors

participated in the transaction, of which about 40% have a dedicated green bonds mandate

• The net proceeds of the issue of Notes (in the form of Green Bonds) will be allocated within FMO’s Treasury to a special

sub-portfolio that will be linked to FMO's lending operations in the field of green finance and inclusive finance (“Eligible

Projects”).

• Eligible green projects include, but are not limited to, investments in:

o Renewable energy projects such as solar, wind, geothermal power and run-of-the-river hydro

o Energy efficiency projects in buildings and in industrial equipment

o Agriculture, forestry and other land use

o Responsible agriculture, food production, transport, waste and wastewater projects (including biosphere

conservation projects)

The above examples of Eligible Projects are for illustrative purposes; for a full list refer to FMO’s SBF:

https://www.fmo.nl/sustainability-bonds-framework

Distribution: