We implement our human rights commitment through our Impact and ESG management framework, which is aligned with the Sustainable Development Goals (SDGs).

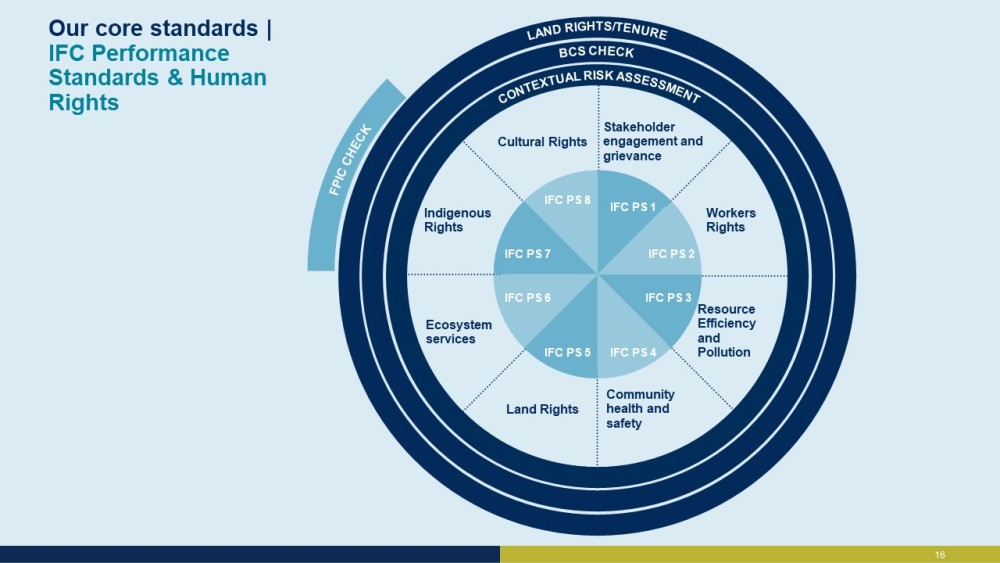

We strengthen specific human rights by investing in sectors that are crucial to economic, environmental, and social progress: Energy, Agribusiness, Food & Water, and Financial Institutions. Our human rights commitment is also an integral part of our ESG risk management. Adopting a human rights-based lens in our ESG risk management helps us to bring local employee, affected community and other stakeholder perspectives to the center of our ESG assessment and influences the engagement with our customers. It also helps us in our review of land tenure related risks, broad community support and contextual human rights risk and in defining individual customer requirements and support in these areas.

We strengthen specific human rights by investing in sectors that are crucial to economic, environmental, and social progress: Energy, Agribusiness, Food & Water, and Financial Institutions. Our human rights commitment is also an integral part of our ESG risk management. Adopting a human rights-based lens in our ESG risk management helps us to bring local employee, affected community and other stakeholder perspectives to the center of our ESG assessment and influences the engagement with our customers. It also helps us in our review of land tenure related risks, broad community support and contextual human rights risk and in defining individual customer requirements and support in these areas.

The IFC Performance Standards are our main instrument for implementing our human rights commitment. We use them as a key reference for identifying human rights risks and impacts, defining customer requirements and responsibilities, and for reviewing human rights performance during the tenor of our engagement. We are further guided by the United Nations Guiding Principles for Business and Human Rights (UNGPs), the OECD Guidelines for Multinational Enterprises, and the other standards referenced in our Sustainability Policy.

Our investment departments are responsible for FMO’s portfolio and they are supported by the Impact and ESG department on high-risk transactions. Our ESG staff is embedded in our investment teams. They support with screening, assessment, structuring and monitoring FMO’s investments with respect to human rights and environmental and social risk management. The Director of Impact & ESG reports to FMO’s Management Board via the Chief Investment Officer. FMO’s credit department, which includes ESG specialists, is independent of the investment teams and reports to the Management Board via FMO's Chief Risk & Finance Officer. The credit department provides advice to the Investment Committee based on scrutiny and challenge of potential investments.

Our investment process consists of the following stages. Through case studies we illustrate how ESG is an integral part of this process.

We identify investment opportunities within our markets that contribute to our three SDGs. We check geographic limitations, the exclusion list, the viability of the investment plan and the business itself. We also check if our investment is additional.

We make an initial assessment of risks and opportunities, define the terms of our engagement, and scope any further assessment needs. We conduct a KYC assessment to ensure that the customer complies with anti-money laundering, anti- corruption and anti-terrorist financing regulations. We also assess potential effects on environmental, social, governance and human rights issues. We document this in a Clearance in Principle (CiP) proposal, informing our decision to continue preparing for a final investment decision.

We carry out a detailed project or client due diligence, which is risk based and inter alia can involve one or more site visits, engagement with interested international and impacted local stakeholders and communities, engagement with local government institutions, engagement of (local) consultants on which we may rely for particular parts of the due diligence, and engagement with peers. We define and negotiate risk mitigation with the client and document the results in a finance proposal informing FMO’s final decision on whether to invest.

|

In practice FMO considered funding a group of food processors that aimed to improve access to staple foods to vulnerable people in a country on the verge of famine. We needed to assess the impact of financing food imports on human rights, but the country’s conflict and COVID-19 situation made it impossible to visit. FMO conducted a virtual due diligence, viewing video footage of the facilities and conducting virtual interviews with staff, UN agencies such as ILO and IOM, local subject matter experts, local Dutch Embassy staff, local and international NGOs. These stakeholders provided valuable information on the human rights risk and mitigation measures. |

Our Credit Department evaluates all finance proposals and writes a credit advice in support of a final investment decision. If the decision is positive, FMO discloses proposed investments for 60 days prior to contracting. This gives stakeholders another opportunity to share information with us that could improve the quality of our investment decision.

|

In practice When asked to approve a refinancing proposal for an existing transmission and distribution customer, FMO was concerned about the number of fatalities at the plant and in the community. Deaths are common in this sector because of electricity theft and poor health and safety measures around plants. FMO views this as a sectoral issue and by 2020 set up internal and external work streams. In 2021, after months of discussions with one of our partners involved in this trajectory, work commenced on a sector-specific health and safety toolkit. This is intended to influence the management and operations of existing and future transmission and distribution customers. FMO approved the transaction based on the ongoing proactive engagement with the issue. |

|

In practice We received a letter from a group of NGOs after FMO disclosed a planned investment in a financial institution (FI). They expressed concerns about the exposure of the FI to projects with high human rights risks. FMO engaged with the NGOs and listened to their information. The NGOs suggested human rights risks could be reduced through improvements to the FI’s grievance mechanism. Based on this, FMO developed and implemented an environmental and social action plan for the transaction, which was enriched by the engagement with the NGOs consortium. FMO continues to work with the FI to enhance its E&S and human rights risk management. |

FMO includes ESG requirements and conditions in its agreements with customers to ensure that they are legally binding. We subsequently disclose a summary of the contracted investments.

Investment staff, management and the Management Board consider human rights issues in their investment decisions and engage with key stakeholders on impact and ESG issues, including human rights. Further, they discuss human rights risk events as they surface through internal management reports and FMO’s Independent Complaints Mechanism. This includes signals pointing to the oppression of or violence (acts or threats) against individuals because of their engagement with projects or activities financed or considered for financing by FMO (see also our Human rights defender approach).

FMO employees are guided in their human rights work by our Code of Conduct, Sustainability Policy Framework and our ESG target. Our human rights commitment is fully integrated in our investment process and in the templates and tools that accompany and guide employees at each step in this process. Furthermore, the FMO Academy, our internal training center, offers a range of ESG courses to FMO employees, including an advanced human rights training.

New FMO employees take part in an introduction and onboarding program. The onboarding program includes a variety of reading materials and training courses on FMO’s vision and strategy, our governance, our culture, compliance matters, travel safety and a mandatory e-learning on human rights fundamentals.