We provide the expertise to improve our investees' business operations, invest in inclusive business models, as well as provide broader support for a vibrant start-up environment in the regions where the program invests.

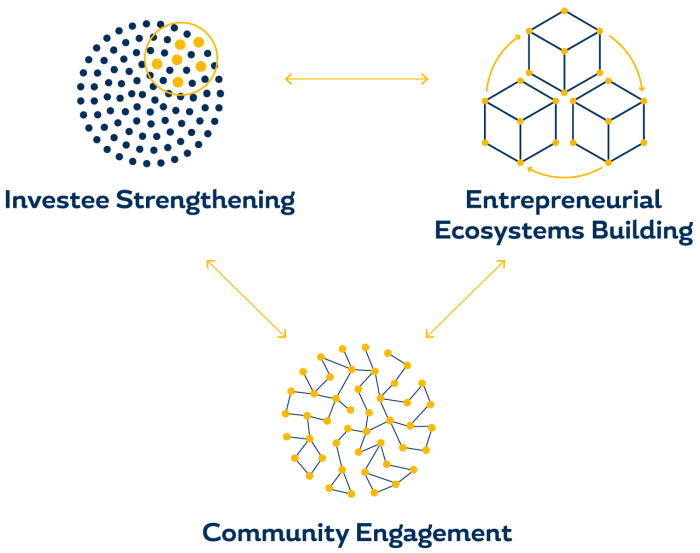

The three complementary components of the Technical Assistance Facility are:

Investee strengthening enables investees to meet relevant standards, improve company performance efficiency and revenue, and increase the impact of their business by providing:

Entrepreneurial ecosystems building focuses on fostering the maturity of the venture capital sector in emerging markets by improving services of incubators, accelerators and other entrepreneurial support organizations, as well as enabling more early-stage financing for ventures.

Our strategic approach to Entrepreneurial Ecosystem building focuses on:

The underlying principles of this approach are to empower existing actors to deliver more sustainable, long term market solutions while co-funding and collaborating with other partners where possible. The Ventures Program is starting ecosystem building efforts by prioritizing three markets – Ghana, Morocco,and Tanzania – through projects with key partners.

This is part of our market creation, a pivotal ambition in our 2030 Pioneer, Develop, Scale strategy. It aims to generate more investment opportunities for development banks and other large-impact investors seeking to contribute to private sector development in the markets and sectors that it currently cannot reach.

With market creation, we are leveraging our investment skills, expertise and partnerships to tackle investment barriers. Our goal is to increase the success rate for early-stage companies and broaden the pipeline of inclusive, impactful, and sustainable transactions. For more information on our market creation approach, click here.

Brings together entrepreneurs with investors and other stakeholders, as well as industry leaders to share lessons learnt and best practices.

For more information on the Technical Assistance Facility and partnerships, please contact us at info.ventures@fmo.nl