Terms of the Transaction

Rating: AAA(Stable) S&P / AAA (Stable) Fitch

Issue amount: USD 500mn

Pricing Date: 12 January 2017

Maturity Date: 20 January 2020

Coupon: 3m USD Libor + 26bps

Format: Floating rate note / RegS

Re-offer Price: 100%

For more information about FMO, please visit: www.fmo.nl/investor-relations

Transaction Highlights:

On 12th January 2017, the Nederlandse Financierings-Maatschappij voor Ontwikkelingslanden N.V. (FMO), the Dutch Development Bank rated AAA by S&P and AAA by Fitch, launched and priced its new USD 500 million 3-year RegS FRN transaction, the issuer’s first transaction of 2017.

Taking advantage of ongoing strong demand for short dated USD SSA paper, FMO secured a clear issuance window by announcing the mandate for a new USD500m (no grow) 3yr RegS RFN transaction during the afternoon of Wednesday 11th January. IPTs were announced at 3m$L+28 area.

The deal attracted strong interest overnight, most notably from Central Banks/Official institutions. FMO were able to open books promptly the following morning with IOIs exceeding the USD500m planned deal size. This enabled price guidance to be revised 1bp tighter to 3m$L+27 area.

Books continued to grow quickly throughout the morning and by 11:10 London had reached over USD650m. At 11:45 the spread was set at 3m$L+26 with books exceeding USD800m for the capped deal.

With final orderbook size in excess of USD925m the deal was priced during the London afternoon at 3m$L+26.

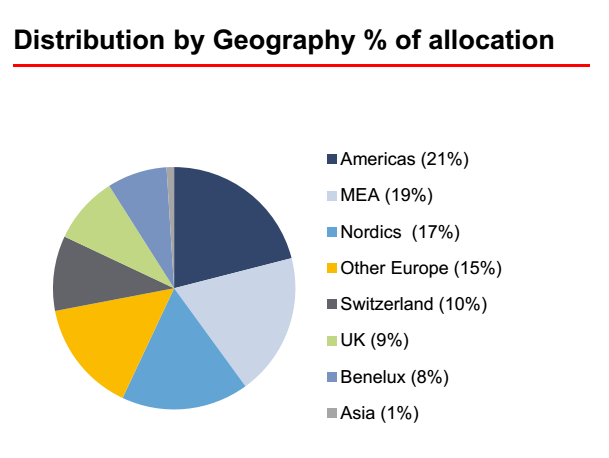

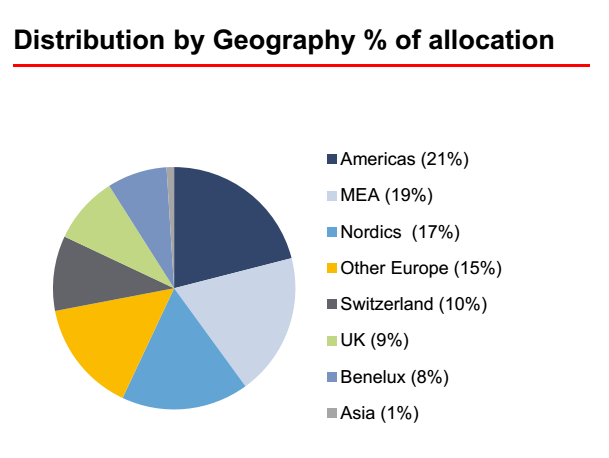

The orderbook was of very high quality with CB/OIs taking over half (57%) and complimentary support from Banks (23%), Asset Managers (19%) and Private Banks (1%). The deal was well diversified globally, attracting strong participation from the Americas (21%), MEA (19%), Nordics (17%) and other Europe (15%) as well as support from Switzerland (10%), UK (9%), Benelux (8%) and Asia (1%).

About FMO

FMO is the Dutch development bank. FMO has invested in the private sector in developing countries and emerging markets for more than 46 years. FMO is 51% government owned, with strong government support via its support agreement with the Dutch state.

For further details please contact: Matthijs Pinxteren (Director Treasury) Tel +31 70 314 95 75 E-mail m.pinxteren@fmo.nl

Arthur Leijgraaff (Senior Treasury Officer) Tel +31 70 314 98 52 E-mail a.leijgraaff@fmo.nl