In the first six months of the year, global economic and political instability prevailed, particularly in FMO’s geographies. High inflation and increasing borrowing costs have made loan repayments and fundraising more expensive for developing countries. This negatively affected the livelihoods of many; the UN Development Programme estimates that the economic shocks of the past three years pushed 165 million people into poverty - using the US$3.65-a-day poverty line - bringing the total to 1.8 billion people.

Meanwhile, climate change continued to disproportionately impact the world’s poorest and most vulnerable. The Horn of Africa, which is experiencing its longest and most severe drought on record, is just one example. FMO is committed to a just and inclusive transition, in which environmental, economic, and social aspects are addressed holistically. However, progress on climate action has been slow. While all governments need to adhere to agreed climate goals, we believe countries that have historically emitted the most must assume the highest responsibility and take decisive action.

Impact performance

Last year, we updated our strategy towards 2030 in order to maximize our impact. Underpinning this ambition, we have set ‘growing impactful business’ and ‘organizational development’ as priorities for this year, while a third element is ensuring FMO’s foundations remain solid.

development’ as priorities for this year, while a third element is ensuring FMO’s foundations remain solid.

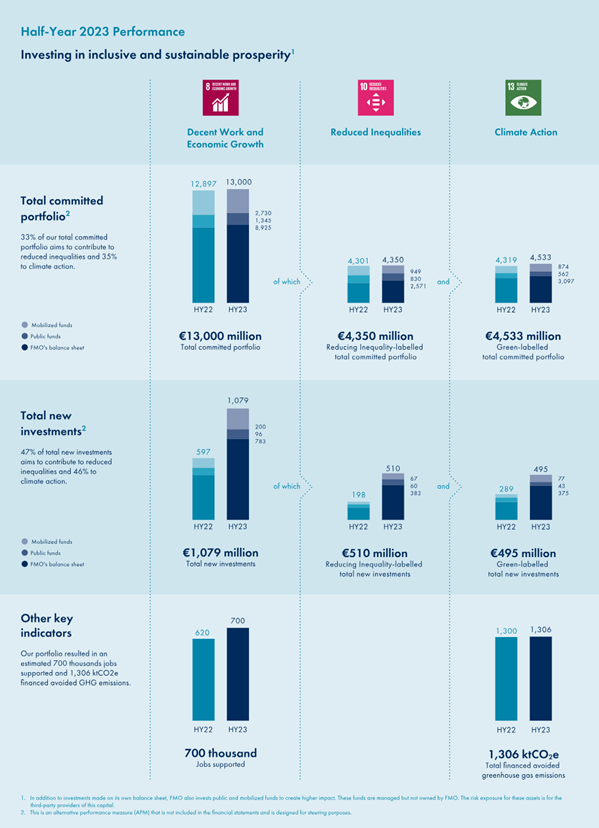

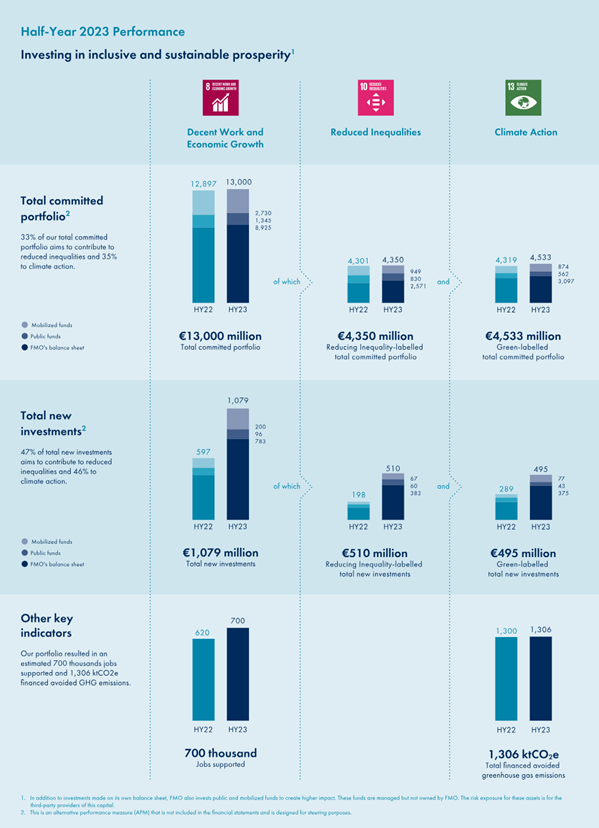

Our results for the first half of 2023 show an increase in volume compared to the previous year. We built up a pipeline of opportunities that resulted in €1,079 million in total new investments, of which €495 million went towards green projects and €510 million towards reducing inequalities. Although we were able to source more opportunities with a greater contribution to the SDGs, investments in least developed countries continued to fall behind. This is due to the previously mentioned political unrest and macroeconomic instability.

A few examples of our impact investments in 2023 include:

- Khan Bank Mongolia issued the first-ever green bond in the country, with FMO investing €35 million in the US$60 million, five-year bond. The bank will grow its climate portfolio by funding projects that support renewable energy, energy efficiency, green buildings, green mobility, and climate-smart agriculture in Mongolia.

- Supporting Taprobane Seafoods, a Sri Lankan company that sustainably produces vannamei (whiteleg) shrimp. The US$15 million loan will help to rehabilitate abandoned shrimp farms, renew hatcheries, and set up eco-friendly processing factories. The loan was financed through Dutch government funds Building Prospects and Dutch Fund for Climate and Development.

- Walo Storage in Senegal. This first battery storage project in West Africa will bring much-needed stability to the local grid and reduce power outages. FMO provided a 16-year loan of €11 million from our own balance sheet (FMO) and a 19-year loan of €8 million from the Dutch government Access to Energy Fund.

- Enabling Faten Palestine for Credit and Development to increase access to finance for un(der)banked groups through a US$10 million loan and a NASIRA risk sharing facility. Despite operating in a very challenging environment, Faten is the largest microfinance institution in the West Bank and Gaza, providing crucial access to finance in the area.

Financial performance

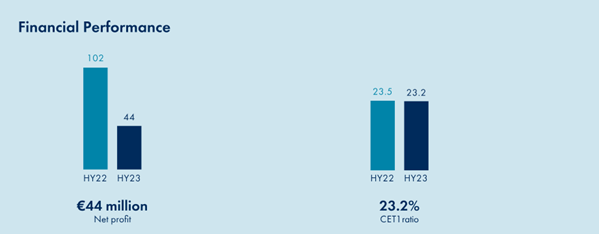

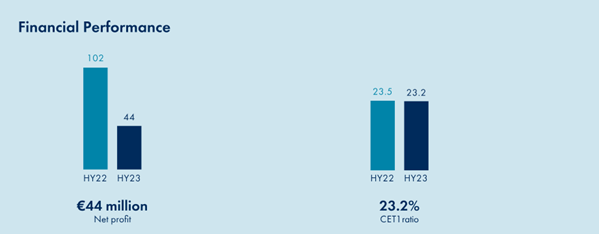

In the first six months of the year (the period ending 30 June 2023), our net profit amounted to €44 million. The movements in the US dollar/Euro exchange rate and devaluation of local currencies against the US dollar, had the biggest impact on our financial performance, resulting in a downward adjustment of our private equity portfolio. Loan provisions were lower than the corresponding amount last year, then largely impacted by exposures in Ukraine, Sri Lanka and Myanmar. The non-performing loans ratio on 30 June was 9.9%. The common equity tier 1 (CET1) ratio at the end of the reporting period was 23.21%.

Organizational development

To increase our impact, comply with regulations and meet the expectations of our stakeholders, we continued to strengthen and streamline our organization. The recruitment of new colleagues progressed well and we prioritized employee wellbeing and engagement. Efficiency is high on the agenda as well.

Effectory, an independent provider of employee feedback solutions, conducted our bi-annual employee engagement survey and classified FMO as a ‘World Class Workplace’, awarded only to organizations that score above the benchmark for engagement and employership.

To ensure FMO continues to meet regulatory requirements, we are in the process of implementing the Corporate Sustainability Reporting Directive and we intend to align with the European Central Bank’s expectations in relation to climate-related and environmental risks by the end of 2024. We are also preparing for alignment with the international banking standards Basel IV, which need to be realized gradually towards 2030.

As part of our Financial Economic Crime Enhancement program, we conducted a full KYC file remediation, finalized at the end of 2021. We followed up on the recommendations in DNB’s conclusions and observations, which also included acknowledgement of the improvements we made. As a result of the file remediation, we reported a limited number of incidents to DNB at the end of 2021 and the beginning of 2022, involving late notifications of unusual transactions to the Financial Intelligence Unit (FIU). DNB reviewed these late notifications and the related KYC files. As a result, DNB decided on enforcement measures. FMO has requested DNB, by means of objection, to reconsider these measures.

Looking ahead

Although we are pleased with the good results in the first half year with respect to impactful investments, we recognize that the outlook for the rest of 2023 remains uncertain due to the fragile global economic and political situation in some of our markets. Still, while achieving the necessary growth and maximizing our impact will be challenging, we see it as our role to be countercyclical and focus on the long term, to invest when others shy away. In light of the challenges that lie ahead, a just and inclusive transition is not an option, but a necessity, and we will do our utmost to contribute to this goal.

For more information, please see the 2023 Interim Report (FMO | Annual and interim reports)

development’ as priorities for this year, while a third element is ensuring FMO’s foundations remain solid.

development’ as priorities for this year, while a third element is ensuring FMO’s foundations remain solid.