USD 500 million 1.750% Benchmark due 12 December 2024

| Rating |

AAA (S&P) /AAA (Fitch) both stable |

| Issue Size |

USD 500 million |

| Payment Date |

24 October 2019 |

| Maturity Date |

12 December 2024 |

| Coupon |

1.750%, Fixed, Annual, 30/360, short first |

| Re-offer Price |

99.876% |

| Re-offer Yield |

1.776% Annual / 1.768% Semi-Annual |

| Re-offer vs Mid Swaps |

+20 bps |

| Re-offer vs Benchmark |

+18.7 bps over CT5 |

| Lead Managers |

Citi, HSBC, JPM, Rabobank |

Issuer: FMO (The Dutch Entrepreneurial Development Bank)

Rating: AAA/AAA (Stable/Stable)

Issuer Size: USD 500m

Payment Date: 24th October 2019

Maturity Date: 12th December 2024

Coupon: 1.750%, Fixed, Annual, 30/360, short first

Re-offer Price: 99.876%

Re-offer Yield: 1.776% Annual / 1.768% Semi-Annual

Re-offer vs Mid Swaps: +20 bps

Re-offer vs Benchmark: +18.7 bps over CT5

Lead Managers: Citi, HSBC, JPM, Rabobank

On Thursday, 17th October 2019, the Nederlandse Financierings-Maatschappij voor Ontwikkelingslanden N.V. (FMO), the Dutch Entrepreneurial Development Bank, rated AAA/AAA, stable outlook by S&P and Fitch priced a successful USD 500 million Reg S long 5-year fixed rate no-grow benchmark. The benchmark offers a 1.750% coupon and a spread of +18.7 bps over Treasuries, equivalent to +20 bps over mid-swaps.

Joint Lead Managers on the deal were Citi, HSBC, JPMorgan and Rabobank.

The long 5-year transaction represents FMO’s second US Dollar denominated benchmark of 2019, following on from a very successful new 5-year Green USD benchmark launched back in February.

The mandate was announced Wednesday afternoon in USD 500 million with Initial Price Thoughts (IPTs) of ms+20a. Books formally opened first thing Thursday morning with Price Guidance unchanged from IPTs, and grew steadily to in excess of USD 500 million by ~ 11:30am CET. The transaction priced at 16.00 CET with books in excess of USD 500million.

Distribution statistics

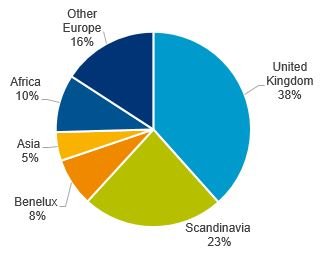

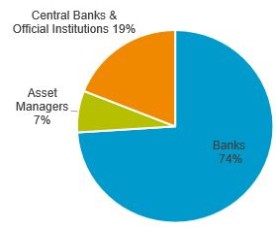

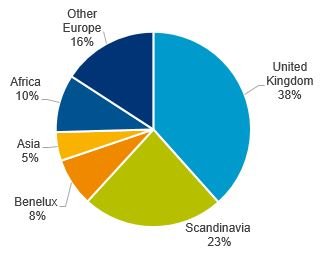

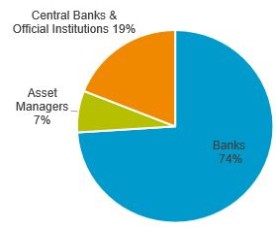

The reward for FMO's broad investor work was reflected in the transaction's high quality and granular orderbook. The book was dominated by Banks who took 74% of the allocations, followed by Central Banks and Official Institutions (19%) and Asset Managers (7%). Investors based in the UK received 38% of allocations, followed by supportive investors in Scandinavia (23%), Other European Countries (16%), Africa (10%), Benelux (8%) and Asia (5%).

| Geography |

Investor Type |

|

|