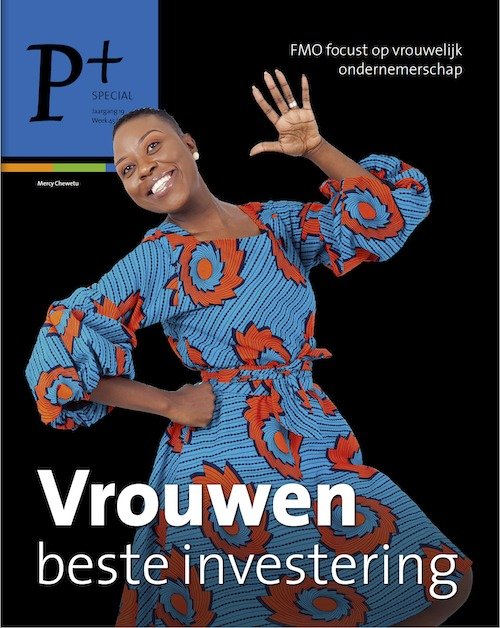

Until recently, a particular focus on female entrepreneurs didn’t get much attention in the financial world. That is changing, as more and more studies show that there is enormous, largely unused potential. Loans to women pay off better. To make use of this knowledge, banks have work to do. Development bank FMO has already started, as this week's P+ Special 'Women's best investment' shows.

Jorim Schraven, Head of Impact and ESG at FMO, says in this Special: "Women have a much better loan repayment rate, up to 50 percent better than men."

His colleague Maaike Platenburg adds: "We have known for a long time that women are good savers, and responsible and loyal customers." Platenburg is manager at FMO's Knowledge Management, Learning & Development team and responsible for evaluations and research. "Our research once again shows the importance of combining funding for small, female-led companies with a range of non-financial services."

In the FMO study, 34 banks worldwide were asked about their experiences." Women almost always start with a disadvantage. That's why courses in management or business skills, mentorship, access to networks and learning from each other are so important. This helps them overcome the systemic barriers that limit their access to finance and markets."

This pays off not only for women-led SMEs, but also for the financial institutions themselves. Banks that integrate such non-financial services into their business plans for female entrepreneurs earn that investment back on average within two years. That's a lot faster than with male entrepreneurs.

"It's a surprising outcome," says Jorim Schraven. "Women often have less collateral than male entrepreneurs. But that also makes them more conservative in borrowing. And that in turn leads to a much better repayment rate, up to 50 percent better than men."

One of the reasons for the lack of funding for female entrepreneurs is the lack of knowledge on facts. Schraven: "Most banks do not have hard financial data on women. They are also completely unaware of the limitations faced by female entrepreneurs. It is only when they develop specific products for that target group that they start collecting that information. And then they are surprised at the positive outcomes."

Read more about this research by FMO in the P+ Special 'Women's Best Investment'.

Text Hans van de Veen