Latin America has the highest concentration of women entrepreneurs in the world with about 40% of all SMEs being owned by women, totaling up to 1.4mln women-owned SMEs.[1] And yet, the region has also the second-highest failure rate of women-owned businesses globally.

Women struggle to get the right finance and support for their businesses. It is estimated that there is a credit gap for women-owned enterprises of USD 98bln in Latin America.[2] Many female entrepreneurs are stuck in the informal sector, unable to grow, which reduces their earning potential and size. Many of them face significant gender-related challenges, including greater domestic responsibility, lower level of financial education, fewer women role models, lack of support networks and lack of capital and assets. At current rates of progress, the World Economic Forum forecasts that it will take 74 years to achieve gender parity in Latin America.

FMO is a supporting partner of the Global Alliance for Banking on Values (GABV) and as such FMO aims to promote value-based banking. Together, we conducted a study that looks into the way women entrepreneurs are served by the financial sector in Latin America and how banks and MFIs can improve their services towards female entrepreneurs to empower them to build successful businesses.

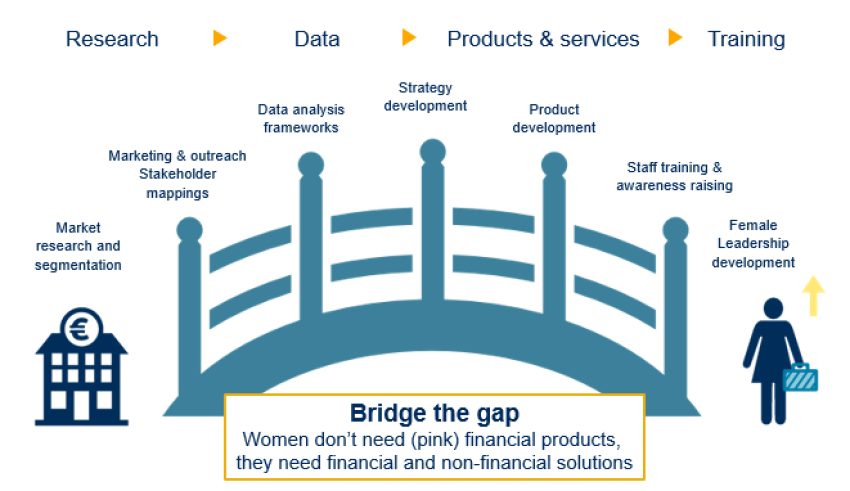

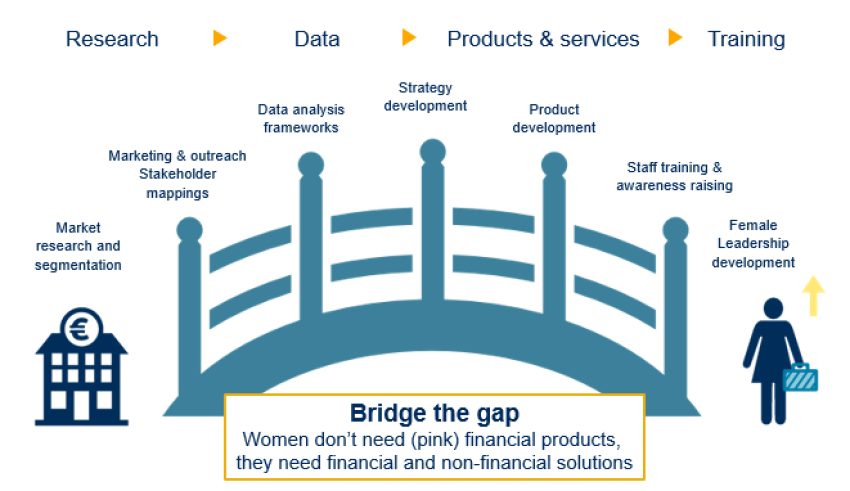

The study indicates that the member banks of the GABV have good basic conditions to advance the path towards the implementation of a successful gender finance approach, but that further moving in that direction will require work on different dimensions. Funding is not the only obstacle for growth. Women face significant gender-related challenges which should also be addressed by tailor-made non-financial solutions, such as facilitating financial education, promoting networks and empowering role models.

To that regard, banks and MFIs need to start adopting a gender smart approach. This requires them to take a step back and analyze market dynamics; what kind of financial and non-financial services are required by women? Financial intuitions can put infrastructure in place to monitor performance of female entrepreneurs in their portfolio and use this data for business decision-making. Then a strategy can be formulated and inclusive products can be developed. Finally, financial institutions have to address internal gender sensitiveness and cultural awareness of their staff on gender concerns in access to finance.

FMO is working with several banks in the region to promote gender finance. In this respect, Produbanco and FMO celebrated the closing of a USD 32mln syndicated loan of which USD 5mln is dedicated towards financing women entrepreneurs and USD 27mln towards green loans. Produbanco is the third largest bank in Ecuador and part of the Promerica Group, one of the largest financial groups in Central America. This is Produbanco’s first dedicated funding towards female entrepreneurs which the bank views as an interesting business opportunity.

Rubén Eguiguren, Vicepresidente de Banca Empresas. Produbanco - Grupo Promerica: “Produbanco is once again partnering with FMO this time to develop a women focused strategy. Our close cooperation has resulted in a better understanding of our women led clientele, their challenges, and opportunities to support their businesses. Produbanco’s commitment to sustainability, reflected on its recent joining to the Principles for Responsible Banking, is already part of its strategy, contributing to a more inclusive society and a safer environment. “

Eowyn Teekens, Senior Investment Officer FMO: "This transaction further deepens the strategic relationship between Produbanco and FMO. Produbanco is a front runner in green lending and was among the first to commit to the UN’s recently launched Principles for Responsible Banking. With this transaction, FMO, together with the syndicate members, will further support Produbanco in increasing its green loan book. In addition, a first gender line will be provided to Produbanco, targeting women owned SMEs, an underserved segment in Ecuador."

By making funding available to women entrepreneurs while looking beyond the surface to understand their needs and struggles and offering services that address them, banks and MFIs can play a key role in the success of women-led MSMEs and drive sustainable economic growth through reducing inequalities.