FMO and Proparco signed a USD 30 million loan to Banque Populaire du Rwanda (BPR), with both parties providing USD 15 million each. Proparco has acted as the mandated lead arranger of the USD 30 million credit facility.

Particularly active in the financing of the productive sector, BPR, part of the Atlas Mara Group, with the second largest by assets in Rwanda, has set ambitious objectives to further support SMEs and corporates in the country. It intends on building on its extensive network of branches throughout the country to reach out to urban and rural businesses alike. In particular, BPR is committed to supporting SMEs via traditional banking products and also Fintech and digital banking, to improve the competitiveness of existing and new businesses.

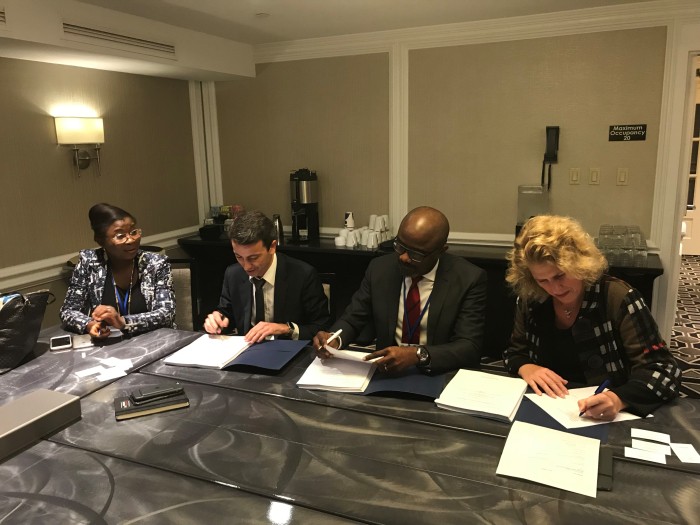

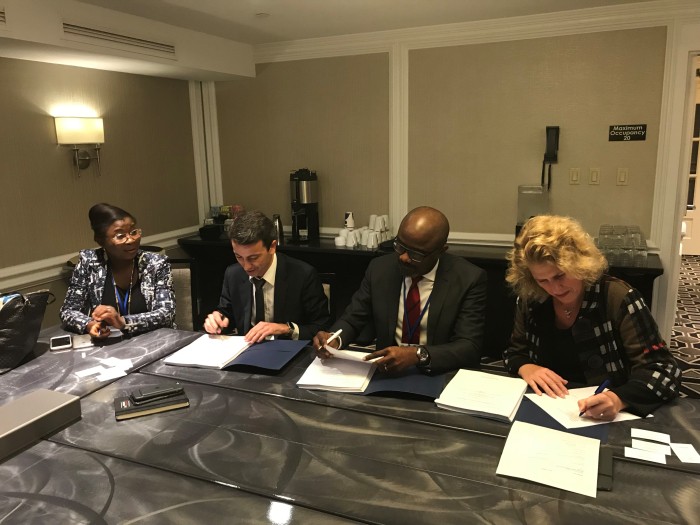

The signing ceremony of the credit facility was held in Washington DC on Saturday 14th October during the IMF/World Bank 2017 Annual Meeting.

Proparco CEO Gregory Clemente said: "We are very happy to join forces with FMO to support BPR's essential role in financing the economic diversification of the country".

Linda Broekhuizen, Chief Investment Officer of FMO added: "Sustainable economic growth starts with creating opportunities for individuals. Helping BPR support more entrepreneurs and businesses to flourish by offering them the means they need, is key to FMO's strategy. Doing that together with Proparco, is a win-win situation for all of us".

Sanjeev Anand, Group MD for Banking at Atlas Mara said: "We are particularly pleased for this pivotal transaction and the great partnership of Proparco and FMO to support our bank in Rwanda. It is our first transaction with Proparco and FMO and we look forward to a long engagement with them as we roll out our business plan across the continent".

Support the backbone of Rwanda's development

These loans are in line with Proparco and FMO's mission to serve sustainable development through their support to the private sector, accounting for 9 out of 10 job creations in developing countries. The facility also provides an important opportunity for future partnership across Atlas Mara banks in Sub-Saharan Africa.