Final Terms of the Transaction

Rating: AAA (S&P) / AAA (Fitch) both stable

Issue Amount: USD 500 million

Pricing Date: 29 August 2018

Maturity Date: 07 September 2021

Coupon: 3m$L +4bps

Format: Floating Rate Note / Regulation S

Re-Offer Price: 100.00%

ISIN: XS1875396506

Lead Managers: BofA Merrill Lynch, Daiwa Capital Markets, J.P. Morgan

On Wednesday, 29th of August 2018, Nederlandse Financierings-Maatschappij voor Ontwikkelingslanden N.V. (“FMO”), the Dutch Development Bank rated AAA by S&P and AAA by Fitch (both stable), launched and priced its new USD 500 million 3-year RegS FRN transaction.

Transaction highlights

-

FMO captured an optimal market window and a very receptive USD space given lack of SSA supply in the currency, driven by cross-currency basis favouring EUR & GBP issuance swapped into USD.

-

The issuer elected to announce its USD 500 million (no-grow) transaction on Tuesday, 28th of August 2018 at 1pm London time, with initial price thoughts set at 3m$L plus 8bps area.

-

Following a stable market backdrop and overwhelming investor demand, indications of interest grew overnight to exceed $1 billion, with books officially opening on Wednesday, 29th of August at just after 8:30am London time and price guidance revised to 3m$L plus 6bps area.

- By 11am London time, books had grown to exceed $1.3 billion and price guidance was subsequently revised to 3m$L plus 5bps area (+1 / -1 WPIR).

Distribution

- 29 high-quality investors participated in the offering, demonstrating FMO’s committed and diverse investor base and highlighting its established position in the capital markets.

-

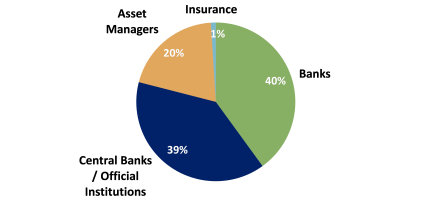

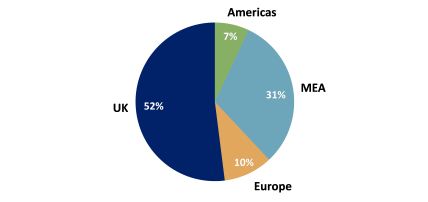

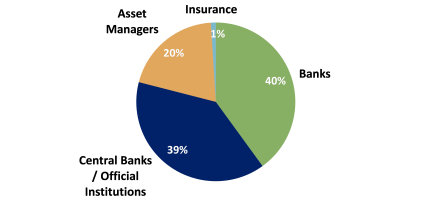

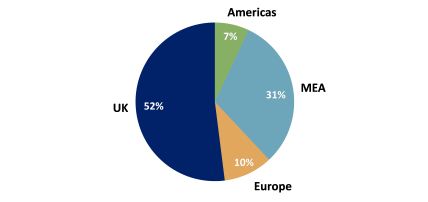

Participation was spread across a broad range of regions and classes, with the UK dominating the overall total of 52%, followed by Middle East & Africa taking 31%, Europe 10%, and the Americas 7%. In terms of investor type, Banks took 40%, Central Banks / Official Institutions 39%, with Asset Managers taking 20% and Pension / Insurance the remaining 1%.

Investor demand by type

Investor demand by region