Transaction Summary:

Issuer: Nederlandse Financierings-Maatschappij voor Ontwikkelingslanden N.V. (FMO)

Format: Reg S, Bearer, New Global Note

Amount: USD 500 million

Settlement date: 6 April 2023 (T+5)

Maturity date: 4 April 2025

Spread: SOFR MS+24 basis points

Coupon: 4.375%; Annual, 30/360, Unadjusted

Coupon Payment Dates: 4 April each year beginning with short first coupon to 4 April 2024 and ending on the

Maturity Date

Listing: Luxembourg

Joint-Lead Managers: BofA Securities, Daiwa Capital Markets Deutschland GmbH /, HSBC Continental Europe,

J.P. Morgan SE

Transaction Highlights

On Thursday 30th March 2023, Nederlandse Financierings-Maatschappij voor Ontwikkelingslanden N.V. (FMO), rated AAA/AAA (S&P/Fitch), priced a USD 500 million 2-year senior unsecured benchmark at SOFR Mid Swaps

plus 24 basis points from Initial Price Thoughts (“IPTs”) of SOFR Mid Swaps plus 27 basis points area, and Guidance of SOFR Mid Swaps plus 26 basis points area. Following several weeks of volatile market conditions, FMO reopened the USD market for SSAs after a 3 week break.

The successful transaction represents FMO’s first fixed rate benchmark of the year. FMO last launched a USD 500m 3-year fixed rate benchmark in May 2022. For 2023, FMO communicated a Borrowing Programme of USD 1-1.5 billion.

The issue carries an annual coupon of 4.375% and will mature on 4th April 2025. It was priced with a spread of 27.7 basis points over the CT2 (T 3 ⅞ 03/31/25) Treasury note, equivalent to SOFR Mid Swaps plus 24 basis points. The pricing translates to a re-offer yield of 4.409% semi-annual / 4.458% annual.

The mandate was announced on Wednesday 29th March at 10am UKT for a series of fixed income investor calls ahead of a new USD 500m (no-grow) RegS Bearer transaction with a 2-year maturity. Following several investor

calls, at 1pm UKT IPTs were released at SOFR Mid Swaps plus 27 basis points area. On the back of good indications of interest (“IOIs”) that were in excess of USD 775 million, the book officially opened on Thursday 30th March at around 8am UKT, with price guidance of SOFR Mid Swaps plus 26 basis points area, 1 basis point tighter than IPTs.

The announcement of IOIs and Official Price Guidance generated further momentum and by 10.20am UKT the order book was already in excess of USD 1 billion (excl. JLM interest). Given the very good quality and size of the order book, the decision was taken to fix the spread a further 2 basis points tighter at SOFR Mid Swaps plus 24 basis points. The transaction ended up 2.2 times oversubscribed with a final book size in excess of USD 1.1 billion.

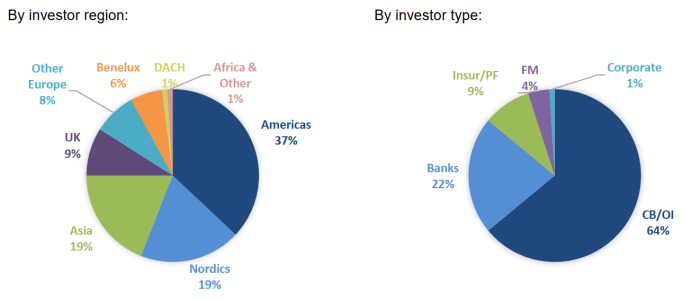

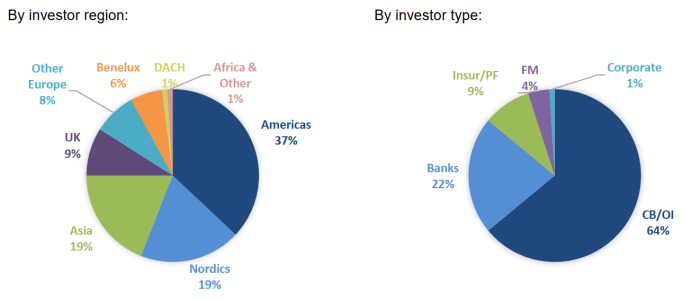

In terms of geographical distribution, the transaction was broadly diversified across Americas (37%), Nordics (19%), Asia (19%), UK (9%), Other Europe (8%), BeNeLux (6%), DACH (1%) and Africa & other accounts (1%).

Central Banks & Official Institutions were the largest investor component taking 64% of final allocations, supported by strong participation from Banks (22%), Insurance & Pension Funds (9%), FM (4%) and Corporate accounts (1%). The broad and global distribution of this transaction is testament to FMO’s support within the global investor community.

This transaction was joint-lead managed by BofA Securities, Daiwa Capital Markets Deutschland GmbH /, HSBC Continental Europe, J.P. Morgan SE.

Distribution statistics

source: Joint Bookrunners