Scientific consensus underlines that in order to meet the goals of the Paris Agreement, we must reduce emissions by almost half by 2030.

Nature will play a central role in the fight against the climate crisis, as healthy biodiverse ecosystems help to sequester planet heating carbon dioxide emissions and support communities in adapting to a changing climate. Accurately understanding the carbon impact of nature projects is key to accelerating the green transition.

Lack of clarity or understanding of carbon impacts can be a barrier for financiers

Investors are starting to pay more attention to the potential of nature-based solutions in reducing greenhouse gas emissions as part of an effective climate crisis mitigation strategy. Investing in projects which protect and restore nature, including tropical forests, can be a key element of financial institutions’ green transition plans. However, measuring the carbon sequestration or avoided emissions of projects is not a straightforward calculation, and the lack of clarity or understanding of carbon impacts of investments can be a barrier for financiers looking to invest in new projects and sectors. Poor carbon modeling which overcount the potential carbon benefits of projects can also lead to reputational risks, such as claims of greenwashing, creating further obstacles to scaling up finance for nature.

A variety of distinct but overlapping carbon modeling tools have been designed to support investors, project developers and decision makers in assessing and comparing carbon removals and avoidance across a range of nature-based solutions projects. However, questions remain on how to use these tools, how different tools compare to each other, which tools can answer which questions, and what decisions can be made using information generated.

Integrity of carbon modeling is key,

Selecting the right carbon modeling tools is critical for making informed investment decisions which deliver climate and nature impacts, as well as financial returns to investors. Integrity of carbon modeling is key, but investors need to find the right balance of granularity and implementability in order to facilitate rather than block the flow of finance into nature based solutions. Different tools will answer different questions with varying levels of accuracy, and so investors may look to use a variety of tools across the investment lifecycle.

At their most basic, carbon modeling tools help decision makers estimate the carbon impacts of a project, activity or economic sector. A subset of these tools are specifically designed to estimate carbon removals and/or avoided carbon emissions from natural climate solutions including reforestation, nature conservation and sustainable land use projects.

Methodologies vary across tools, but in general they extrapolate the carbon removed or avoided through calculations on the carbon stock estimate of different ecosystems (or emissions caused from degrading the ecosystem in the case of avoided carbon), the land area covered, and time scales of projects. From there, methodologies can diverge greatly: some tools are built on international guidelines for greenhouse gas inventories, such as the IPCC’s Guidelines for National GHG Inventories’ tiered approach, others model based on counterfactuals; some tools generate insights on unit of carbon removed, avoided or emitted per product, whereas others analyze the likelihood of project effectiveness. These differences in methodologies mean that the tools can be used for different purposes from modeling potential impacts, to accounting towards climate targets, monitoring results or screening project risk.

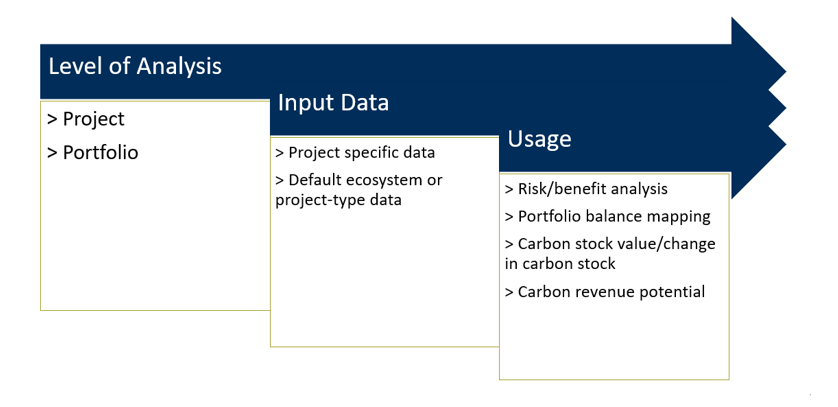

Different carbon modeling tools can be used to generate insights at either the project or the portfolio level of analysis. For more granular analysis of project carbon removal or avoidance, some tools will require detailed data inputs about project specifics, whereas other models may be based on high level assumptions to facilitate faster activity-based analyses which generate an indicative carbon impact range.

For example, an investor looking for guidance on how to build a portfolio which maximises carbon sequestered may use a high level tool which uses activity-based assumptions to map how different investment mixes will advance the portfolio towards a set carbon removal target. This type of tool is useful at the fund or portfolio strategy development stage. On the other hand, an investor needing to understand how a specific project will deliver on carbon removed/avoided per dollar avoided would need a different tool, one which uses granular project data to generate insights on project carbon returns. This tool would form part of the decision making process on whether or not to move forward with a specific investment.

High integrity modeling tools can serve an important role in demystifying the natural assets sector for investors who want to explore a variety of climate mitigation and nature protection investments. Robust use of carbon modeling tools can help to address real and perceived risk to investing in nature and thus help to accelerate the flow of finance into protecting and restoring ecosystems. Investors need to understand the menu of different carbon modeling tools and be empowered to implement the ones they need in order to scale up financial flows towards projects which will help mitigate the climate crisis.

Visit our community platform for our latest knowledge products.