Right after the 2015 elections, FMO started to invest in Myanmar’s financial sector. An evaluation was conducted to assess the impact of FMO’s early engagement for the banking sector, local economy and financial inclusion.

Myanmar is one the poorest countries in South East Asia. It was long considered a pariah state while under oppressive military rule from 1962 until 2011. A gradual liberalization began in 2010, leading to free elections in 2015 and the installation of veteran Aung San Suu Kyi (who was reelected in 2020) as president. Yet multiple conflicts persist today, with continued army operations against the Rohingyas, an ethnic minority, and international human rights abuses.

Before the military rule, Myanmar’s banking sector was considered “the envy of Asia” with 10 domestically owned and 14 foreign-owned banks. Yet, the military’s nationalization efforts and a severe banking crisis in 2003 left the financial sector underdeveloped. Larger, state-owned and domestically owned private banks continue to dominate the sector nowadays, leaving smaller loans and products out of reach for many citizens, micro- and small business entrepreneurs. Microfinance Institutions (MFIs) did exist, but they were not allowed to take on foreign debt, or required lengthy and difficult regulatory approval, hampering their growth and ability to provide affordable finance to entrepreneurs.

Microfinance Institutions did exist, but they were not allowed to take on foreign debt

Following the 2015 elections, FMO together with Accion and Triodos microfinance invested in Early Dawn Microfinance (presently known as DAWN) to establish it as a microfinance institution (MFI). It was one of the earliest MFIs in Myanmar, originally launched as a program from the NGO Save the Children. In 2016, when the restrictions on providing foreign debt were lifted, FMO stepped in as one of the first foreign lenders and extended a loan to Early Dawn. In the following years FMO also provided loans to the MFIs Acleda (2017), Thitsar Ooyin (2018) and Maha (2019). At the moment, FMO has nine investments in the financial sector in the country (see here).

Because of FMO’s interest in Myanmar combined with the country’s potential, an evaluation was launched. The research agency SEO Amsterdam Economics reviewed how FMO and the MASSIF fund contributed to the financial sector and its impact on the livelihoods of the people in Myanmar. It turned out that where other foreign lenders struggled to cover their foreign exchange risks against reasonable terms, FMO was able to extend unhedged local currency loans through the MASSIF fund. So FMO could step in and support the financial sector shortly after the liberalization in the country. The consultants also found strong indications that FMO’s early involvement significantly helped attract more (foreign) investments due to the reduction of perceived investment risk (FMO’s “stamp of approval”). FMO also contributed by reducing actual risks for new investors by providing funding stability and improving corporate governance. By investing so early and helping the Micro Finance Institutions (MFIs) develop when few other investors dared or were able to, FMO played a highly additional role in the country in the past six years.

In 2013 many Burmese consumers did not have access to formal banking products and services

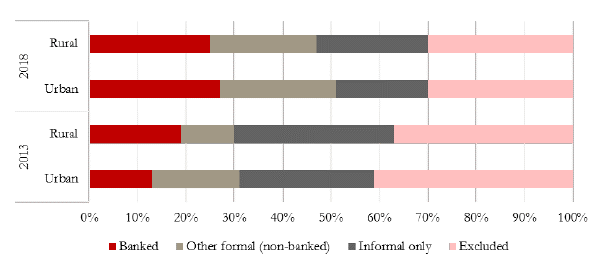

In 2013 many Burmese consumers did not have access to formal banking products and services (see figure). When in need of money, almost 70% of Burmese consumers could only turn to informal “loan sharks”, that charge up to 20% interest per month, or to friends and family.

By 2018, significant progress was made: the un- or informally banked portion of the population dropped to 50%. The evaluation concludes that with the help of MASSIF funding, FMO made a positive contribution to this progress. Moreover, it created access to finance for underserved groups like women and people in the rural areas of Myanmar. For instance, Dawn Microfinance has a 99% female customer base and the MFIs Thitsar and Maha only finance rural consumers.

If I had not received this loan, there would have been little chance for a villager like me to improve my life.

Improved access to finance against better conditions supports microentrepreneurs in their businesses activities as a survey (that was conducted as part of the evaluation) among nearly 2,000 MFI- clients confirmed.

Nearly 90 percent of respondents stated that MFI loans enabled them to buy more inputs, hire new employees, and produce more output. Another 85% of the clients confirmed they were now able to improve their livelihoods. As one MFI client illustrated: “If I had not received this loan, there would have been little chance for a villager like me to improve my life.”

The survey provided valuable customer insights for the involved MFIs. Julio Pinzon, Head of Risk and Special Projects, at DAWN: “Hearing customers say they are happy and understanding how it helps them, is strengthening the confidence in our business model. The Operations team finds strong motivation for their work by seeing the positive impact that our products create”.

Focus financings on digitization and mobile banking

The consultants made nine recommendations to increase FMO’s impact in Myanmar. They recommended to focus MASSIF funding on smaller and niche MFI players that serve the rural parts of the country. FMO instead can focus its financings from its own balance sheet more on digitization and mobile banking. FMO is already targeting more developed financial institutions and supporting their expansion and digitization, like for instance its latest investment in the largest MFI in the country, Pact Global Microfinance Fund. And MASSIF will continue to focus on niche players with large funding gaps.

The consultants also see potential for FMO and MASSIF to increase development impact in non-financial ways, for example by reducing over-indebtedness (an emerging threat along with the growth of the financial sector). With increased capacity at FMO to work on sector-wide initiatives, FMO will actively look for opportunities to work on over-indebtedness in the country.

Credit risk management and digitization at MFIs remain strategic focus areas for FMO and MASSIF’s Capacity Development program. During the summer, FMO and MASSIF supported several MFIs with COVID-19 emergency grants to help them managing the impact of the pandemic on their business models.

SEO Report | Evaluation of FMO-MASSIF investments in four microfinance institutions in Myanmar