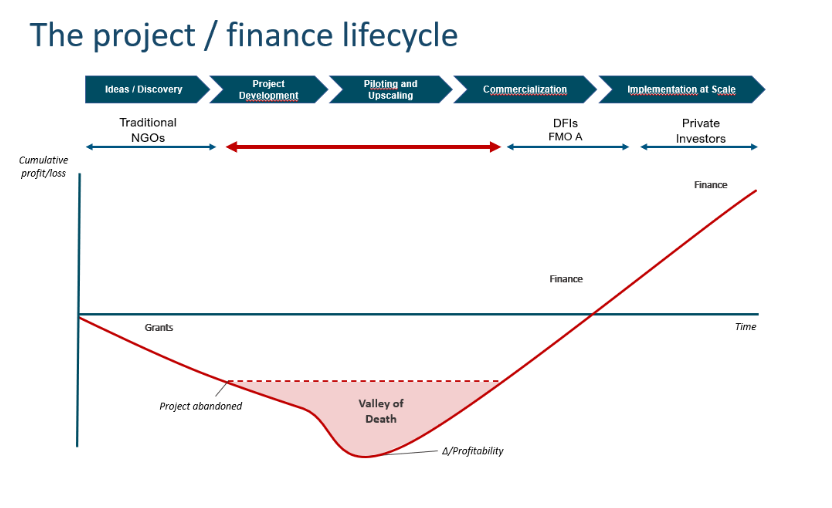

While there is financing available to address climate adaptation, there is a dearth of bankable opportunities. Most promising projects that rely on development grants get abandoned before they reach profitability.

The need for climate adaptation is clear and getting increasing attention. The latest IPCC report underlines this, showing that costs for adaptation will rise from USD 140 billion to USD 300 billion by 2030.

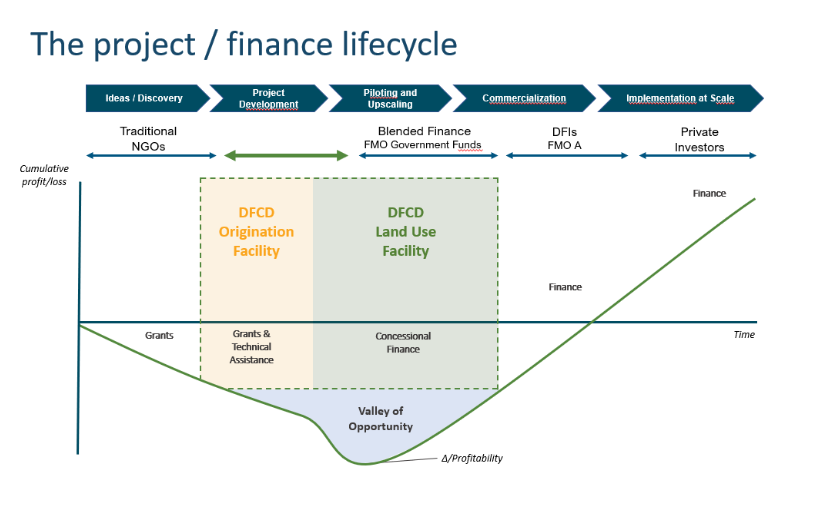

To bridge the gap from ideas to commercialization, the so-called ‘valley of death’, development organizations need to work together on project development, piloting, and upscaling. In other words, there is a need for market creation. The Dutch Fund for Climate and Development (DFCD) was established to meet this need.

DFCD is managed by a consortium consisting of SNV and WWF, which manage the Origination Facility, and FMO and CFM, which manage the Land Use Facility and Water Facility, respectively. The Origination Facility is meant to identify promising projects in climate adaptation and mitigation with a good chance of becoming bankable, and support them with technical assistance to develop their business plan, at which stage FMO or CFM can provide high-risk, early-stage financing. The fund adopted a so-called landscape approach, which promotes long-term collaboration among multiple stakeholders within a landscape and the development of a pipeline of interlinked projects for more impact on inclusive climate resilience. In 2021, FMO commissioned ITAD to perform an evaluation, on the initial implementation of the DFCD, with a focus on the origination approach.

The four partners complement each other through the local presence and expertise.

The evaluation finds that the DFCD clearly made progress on identifying projects with the potential of becoming bankable, although none of the projects from the Origination Facility have at the time of the report received financing. Some of these projects would not have been pursued without DFCD involvement, meaning that if they become successful in securing investment the DFCD would have a high degree of additionality. Furthermore, FMO and CFM have independently identified and financed other projects through the DFCD. This progress was achieved against a backdrop of the Covid-19 pandemic

The four partners complement each other through the local presence and expertise of WWF and SNV and the investment expertise of FMO and CFM, as was recognized by their clients. The long experience and local presence of WWF and SNV was useful to find projects, and in order to improve alignment with the investment facilities, they recruited staff with banking and investment expertise. Further, through collaboration with partners and initiatives such as the “Scalable Climate Solutions Challenge” they identified potentially bankable projects.

Nevertheless, collaboration between organizations within a consortium also has its challenges. For example, there had been differing expectations regarding the extent to which a project should be de-risked through its E&S standards to be considered for investment. As such, the report recommends partners to proactively collaborate to align E&S processes, formalize consultation processes, and ensure and regular engagement between investment and origination facilities at an early stage. As a result of this study, connection between CFM and WWF will be intensified with regular recurring meetings, and the possibility of a secondment between the partners will be considered.

The study also looked into the innovative and ambitious landscape approach that the DFCD uses as it is essential to the origination facility. Synergies between projects in a landscape have the potential to boost landscape-level resilience in the long term, as well as helping sponsors and investors reduce their risk. However, it is noted that the landscape approach is challenging to implement due to the large-scale and long-term nature of the approach. Further, sponsors perceive the landscape approach as slowing progress in their business development activities. Peers recommend focussing on key values and drawing further on stakeholder engagement.

The DFCD is in the early stages of implementation but is already aligned with many best practices in its roll-out of the landscape approach. For example, it also implements a rapid landscape study which allows for consideration of core landscape issues without delaying the DFCD’s origination and investment progress. Following the evaluation, it will also establish an updated set of values for the landscape approach, including further engagement with multi-stakeholder platforms and financial intermediaries to reach multiple projects. The DFCD will also monitor impact both at project level and at landscape level (multiple projects in a landscape) and deliver a joint narrative as consortium.

Finally, the report also outlines important findings for future funds to consider, particularly to learn from the success factors of the DFCD, such as the consortium approach which helps combine various skills and networks, and has real potential to bring more projects to commercialization. Extensive engagement and devoting time to alignment of standards and processes can further enrich these synergies, providing a possible template for bridging the ‘valley of death’ in other high-impact areas.