How does the evidence support MASSIF's impact hypothesis, and how can certain practices maximize MASSIF's impact?

MASSIF is a fund designed to support micro, small and medium entrepreneurs operating (MSMEs) in the poorest and worst-served segments with financial inclusion measures. In low-income countries or fragile states in particular, intermediaries play a key role in mobilizing these businesses; the fund supports them, with special attention paid to women and youth-owned MSMEs.

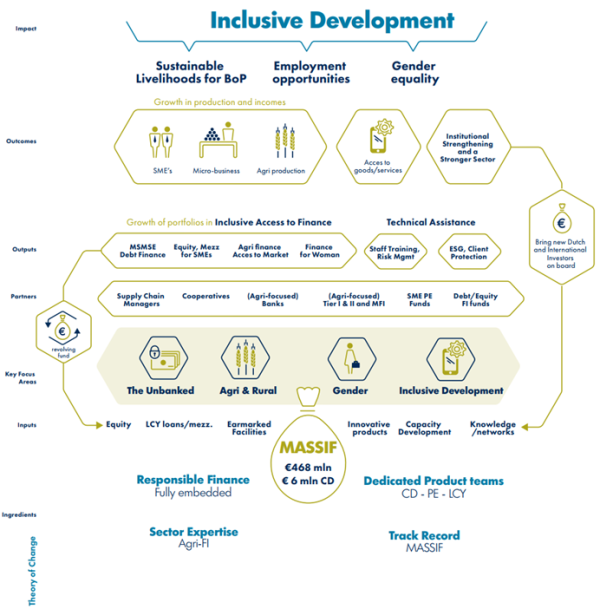

In 2016, MASSIF adopted a new strategy dubbed “The Next Frontier: 2017-2026". It contained an updated Theory of Change (ToC) and focused on four specific themes for investments: the unbanked, agriculture and rural livelihoods, women-owned MSMEs, and innovations in inclusive business. This is where MASSIF aims to make a difference by creating more employment opportunities, by improving overall livelihoods and promoting gender equality.

Following the evaluation of MASSIF by the Dutch Ministry of Foreign Affairs last year, FMO commissioned Dalberg Advisors to conduct a robust review on the state of evidence supporting MASSIF’s Theory of Change to establish where evidence on MSME financial inclusion is strong (or and where it is not). In addition, the purpose of this study was to assess whether the direction of the evidence supported MASSIF’s impact hypotheses, and whether there were any critical conditions or promising practices that could maximize this impact. Dalberg reviewed over 200 research papers to analyze 12 hypotheses related to different impact pathways of the ToC. The studies were assessed and rated for relevance, quality of publication, methodology, and demonstrated impact.

Globally, there is convincing evidence that investing in MSMEs contributes to their growth, which in turn has a positive impact on sustaining livelihoods. However, more granular research into the impact on job creation is needed.

In the Unbanked sector, primarily composed of fragile states and those with low financial penetration, there is evidence of contribution to sustainable livelihoods, but less about enabling access to finance. Furthermore, evidence on the impact of microfinance institution (MFI) interventions in serving MSMEs in this context is mixed.

With regards to agriculture-based MSMEs, there is evidence that access to finance can help them to grow and deliver sustainable livelihoods and employment. Evidence about the impact of fintech solutions is limited, although mobile money has proven to be an effective tool, and there are other promising areas to explore in this context.

The evidence map also showed that whilst support for women-owned MSMEs boosts employment, sustainable livelihoods and gender equality, less is known about how fintech solutions can help this segment, or if funds earmarked for women have a catalytic effect on investment.

The study revealed that with Inclusive Business, there is compelling evidence to state that microinsurance helps build resilience among farmers, especially smallholders, but evidence is scarce regarding the impact on MSMEs.

In terms of capacity development, (CD) there are indications that more digitalized financial institutions could increase the uptake of financial services among the underserved MSMEs, but more evidence is needed to support this claim. Furthermore, there is limited evidence on the effectiveness of capacity development in helping intermediaries digitalize in an inclusive way, or on the role of incubators/accelerators in effectively supporting youth-led enterprises.

On the question of client protection principles (CPPs), while their implementation by financial institutions is well understood, little is known about whether they actually reduce risks from the customers’ perspective, or if CPPs improve the uptake of financial services (by MSMEs).

MASSIF operates in frontier markets and invests in innovative new business models. Given the profile of the fund, the available academic research is often limited, as highlighted by Dalberg. This study helps inform FMO and its future research agenda and hopes to inspire other market participants to focus on evaluation and impact assessments in areas where limited evidence is available.

Furthermore, this evidence map helps MASSIF’s fund management and investment teams articulate the impact of their work, by leveraging existing evidence to support investment decisions and seeking investments that can demonstrate impact for less-evidenced pathways (e.g., on nascent fintech models).

If you are interested in learning more about the findings of the mapping, you can download the full report here.

To download the full report, please click here.

For our other evaluations and reports, visit our reporting center.